U.S. Taxation of International Transactions

About this Course

This course analyzes the tax treatment, issues, planning techniques and underlying government policies involved in doing business internationally. The course incorporates concepts learned in all of the tax courses as they relate to the impact on cross-border outbound transactions (i.e., the taxation of US taxpayers doing business abroad). Topics include the source of income, transfer pricing, controlled foreign corporations (CFCs), Subpart F income, foreign tax credits, Global Intangible Low-Taxed Income (GILTI), Base Erosion and Anti-Abuse Tax (BEAT), and Foreign Derived Intangible Income (FDII). While this course focuses heavily on outbound transactions, some inbound rules (i.e., non-US taxpayers doing business in the United States) will be discussed. This course is an introductory course, so no prior knowledge of international taxation is required or expected. However, prior knowledge of U.S. federal taxation is necessary.Created by: University of Illinois Urbana-Champaign

Related Online Courses

This is a self-paced lab that takes place in the Google Cloud console. In this lab you will configure and test point-in-time recovery for a Cloud SQL for PostgreSQL instance.Created by: Google Cloud more

This course deals with tension. Tension is one of the easiest forces to understand. It is a pulling force. When we tend to pull an object, it is in tension. Different elements that resist tension... more

Learners may study at their own pace to take any of the six courses and the Capstone Project course independently (receiving a certificate for each) or collectively for the specialization... more

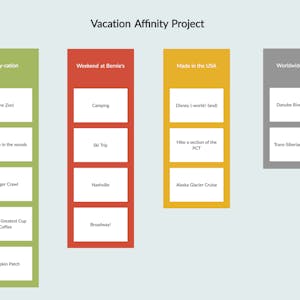

By the end of this project you will create an affinity diagram using Creately.com. Learning to collect and organize ideas and information increases productivity and fosters positive teamwork.... more

This is a self-paced lab that takes place in the Google Cloud console. Get started with sports data science by importing soccer data on matches, teams, players, and match events into BigQuery... more