Payroll and Tax Fundamentals

About this Course

Using the pay statement as our roadmap, this course covers the basics of payroll that everyone who receives a paycheck should know. Starting with your classification as an employee, you\'ll learn why certain new hire forms are required; how to calculate various payroll amounts, including gross and taxable wages, deductions, and certain taxes; how pretax deductions and benefits impact your taxes; and how your pay statement year-to-dates are used to generate a W-2. All this so you can make sure you are being paid accurately.Created by: Automatic Data Processing, Inc. (ADP)

Related Online Courses

Welcome to \"Foundations of Music Promotion & Branding,\" the foundational pillar of the \"Building Your Audience for Music Professionals\" Specialization. Spanning over four detailed modules, this... more

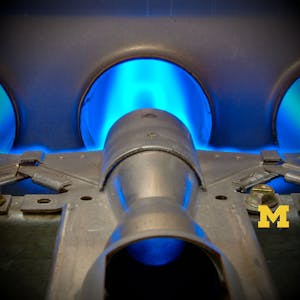

COURSE DESCRIPTION This course provides an introduction to the most powerful engineering principles you will ever learn - Thermodynamics: the science of transferring energy from one place or form... more

This is an Intermediate Course intended for learners passionate about Android Development and have basic knowledge of Android Development. Embark on a comprehensive exploration of Android\'s... more

Biostatistics is the application of statistical reasoning to the life sciences, and it\'s the key to unlocking the data gathered by researchers and the evidence presented in the scientific public... more

Embark on an immersive journey into deep learning, where theoretical concepts meet practical applications. This course begins with a foundational understanding of perceptrons and neural networks,... more