Financial Engineering and Risk Management

About this Specialization

This specialization is intended for aspiring learners and professionals seeking to hone their skills in the quantitative finance area. Through a series of 5 courses, we will cover derivative pricing, asset allocation, portfolio optimization as well as other applications of financial engineering such as real options, commodity and energy derivatives and algorithmic trading. Those financial engineering topics will prepare you well for resolving related problems, both in the academic and industrial worlds.Created by: Columbia University

Related Online Courses

This specialization is intended for business professionals or students seeking to improve their English language skills by using business related content. Through three courses, you will cover, for... more

This is a self-paced lab that takes place in the Google Cloud console. In this lab, you will learn how to use Google\'s Vertex AI SDK to interact with the pre-trained Image Generation AI model,... more

This capstone project has been designed as an opportunity to practice what you have learned in the first 3 courses of this specialisation. This capstone project consists of 4 assignments. You will... more

In this 1.5-hour long project based course, you will learn how to use NetBeans 20 to develop a cross-platform application that can be deployed to any operating systems that support Java such as... more

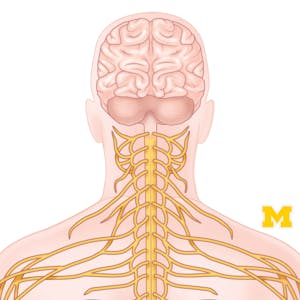

In this anatomy course, part of the Anatomy Specialization, you will be introduced to the central and peripheral nervous systems. You will learn about basic neuroanatomy, sensory pathways, motor... more