Reinforcement Learning in Finance

About this Course

This course aims at introducing the fundamental concepts of Reinforcement Learning (RL), and develop use cases for applications of RL for option valuation, trading, and asset management. By the end of this course, students will be able to - Use reinforcement learning to solve classical problems of Finance such as portfolio optimization, optimal trading, and option pricing and risk management. - Practice on valuable examples such as famous Q-learning using financial problems. - Apply their knowledge acquired in the course to a simple model for market dynamics that is obtained using reinforcement learning as the course project. Prerequisites are the courses \"Guided Tour of Machine Learning in Finance\" and \"Fundamentals of Machine Learning in Finance\". Students are expected to know the lognormal process and how it can be simulated. Knowledge of option pricing is not assumed but desirable.Created by: New York University

Related Online Courses

Forbes AI stats* show that 86% of consumers prefer Humans to Chatbots. This means the consistency of AI-generated responses is crucial for building trust with users and maintaining brand reputation... more

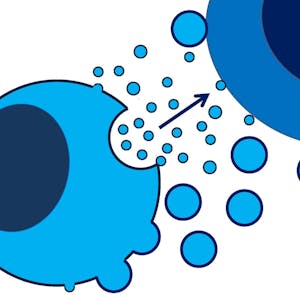

This course aims to provide the basic knowledge about extracellular vesicles (EV) a generic term including exosomes, microvesicles, microparticles, ectosomes, oncosomes, prostasomes, and many... more

Supply Chains are made up of a network of companies from the initial raw materials to the ultimate consumer of the finished product. Within this network of companies, there are three ongoing flows:... more

While most specializations on Coursera conclude with a project-based course, students in the \"Fundamentals of Computing\" specialization have completed more than 20+ projects during the first six... more

In the complex landscape of modern business, Corporate Governance emerges as a critical pillar for companies aiming to navigate ethical, legal, and competitive arenas successfully. This course... more