Taxation of Business Entities I: Corporations

About this Course

This course provides an introduction to the U.S. federal income taxation of corporations and their shareholders. The course focuses on the relevant provisions of Subchapter C of the Internal Revenue Code, as well as related Treasury Regulations and judicial opinions, governing corporate formation, operations, distributions, and liquidation. Practical in-class study problems facilitate self-discovery of technical tax knowledge along with the development of a variety of professional skills and attitudes.Created by: University of Illinois Urbana-Champaign

Related Online Courses

This is a self-paced lab that takes place in the Google Cloud console. In this lab, you will learn how to build and deploy an agent (model, tools, and reasoning) using the Vertex AI SDK for... more

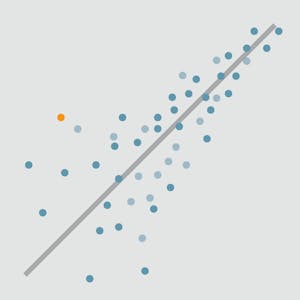

This course introduces simple and multiple linear regression models. These models allow you to assess the relationship between variables in a data set and a continuous response variable. Is there a... more

This course is designed for data analysts who want to learn about using BigQuery for their data analysis needs. Through a combination of videos, labs, and demos, we cover various topics that... more

This series of courses begins by introducing fundamental Google Cloud concepts to lay the foundation for how businesses use data, machine learning (ML), and artificial intelligence (AI) to... more

In this course, you will learn how the changing Arctic environment is tied to the growing economic and strategic importance of the North. After setting the stage through a review of the peoples of... more