Derivatives

About this Course

This course covers standard derivative pricing models. Both discrete time and continuous time techniques are considered. The course also includes an introduction to numerical option pricing, in particular the Monte Carlo Method. After this course, students should have a good knowledge of financial markets, security pricing, arbitrage, interest rates, risk and return. Contents: 1) Definition and classification of financial assets 2) Discrete-time pricing models 3) Continuous-time pricing models 4) Fixed income products 5) Monte Carlo methods for derivative pricingCreated by: Università di Napoli Federico II

Related Online Courses

This first of five courses introduces students to the social determinants of health, and provides an overview of the definitions and theoretical perspectives that will form the foundation of this... more

This is a self-paced lab that takes place in the Google Cloud console. In this lab you will learn how to use Dialogflow tools to troubleshoot your Virtual Agent.Created by: Google Cloud more

In this specialization, you will learn how to define Cybersecurity risk and discuss the threats that create it while you also learn to describe the role of Cybersecurity management in the... more

Computing systems and technologies are impacting the lives of most people the world, and will do so even more in the future. These impacts include how we get information, how we socialize, how we... more

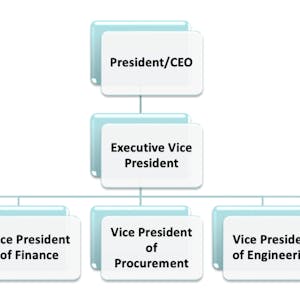

This course is primary focused on Procurement Organization-how to integrate procurement into the business and with your suppliers, review different types of procurement organizations, the... more