Classification and valuation - What you must know!

About this Course

This is the second course in Tax Academy\'s Customs Certification. This certification would provide you with relevant skills to apply Customs knowledge in less than two months. In this course, you will build upon your knowledge on legal principles of classification and valuation of goods. Once you are able to correctly classify and declare the value of goods, you will be able to take accurate decisions about Customs duty payment and ascertain other compliance requirements. Correct classification and valuation is also important for GST-related disclosures, and consistency under the two laws is necessary from a compliance standpoint. Learners who complete this certification can gain the skills required to apply to introductory job positions in the industry or consultancies.Created by: PwC India

Related Online Courses

Although traditional marketing strategies are still used, companies continue to shift their focus to digital approaches such as search engines, social media. These technologies take into account... more

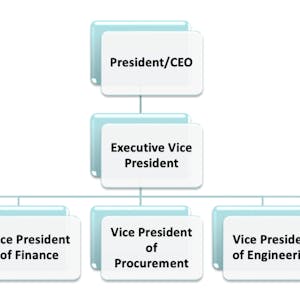

This course is primary focused on Procurement Organization-how to integrate procurement into the business and with your suppliers, review different types of procurement organizations, the... more

This Specialization is for learners interested in exploring or pursuing careers in data science or understanding some data science for their current roles. This course will build upon your previous... more

This course is designed for anyone who is interested in learning more about modern astronomy. We will help you get up to date on the most recent astronomical discoveries while also providing... more

This is the second course in the IBM AI Enterprise Workflow Certification specialization. You are STRONGLY encouraged to complete these courses in order as they are not individual independent... more