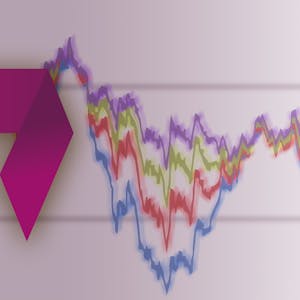

Interest Rate Models

About this Course

This course gives you an easy introduction to interest rates and related contracts. These include the LIBOR, bonds, forward rate agreements, swaps, interest rate futures, caps, floors, and swaptions. We will learn how to apply the basic tools duration and convexity for managing the interest rate risk of a bond portfolio. We will gain practice in estimating the term structure from market data. We will learn the basic facts from stochastic calculus that will enable you to engineer a large variety of stochastic interest rate models. In this context, we will also review the arbitrage pricing theorem that provides the foundation for pricing financial derivatives. We will also cover the industry standard Black and Bachelier formulas for pricing caps, floors, and swaptions. At the end of this course you will know how to calibrate an interest rate model to market data and how to price interest rate derivatives.Created by: École Polytechnique Fédérale de Lausanne

Related Online Courses

The ability to engage stakeholders is an increasingly important competency that requires tact, strategy, collaboration, and high quality communication skills. Solving complex problems effectively,... more

This course is designed for high school students preparing to take the AP* Physics 1 Exam. * AP Physics 1 is a registered trademark of the College Board, which was not involved in the production... more

The specialization \"Neuromarketing\" is intended for post-graduate students seeking to develop expertise in neuromarketing and neuroscience methods. Through three courses, you will cover topics... more

This specialization is a three course sequence that will cover the main topics of undergraduate linear algebra. Defined simply, linear algebra is a branch of mathematics that studies vectors,... more

This course introduces you to the fundamental concepts of sustainability and Environmental, Social, and Governance (ESG) frameworks. Through a structured exploration of sustainability\'s three core... more