Financial Engineering and Risk Management

About this Specialization

This specialization is intended for aspiring learners and professionals seeking to hone their skills in the quantitative finance area. Through a series of 5 courses, we will cover derivative pricing, asset allocation, portfolio optimization as well as other applications of financial engineering such as real options, commodity and energy derivatives and algorithmic trading. Those financial engineering topics will prepare you well for resolving related problems, both in the academic and industrial worlds.Created by: Columbia University

Related Online Courses

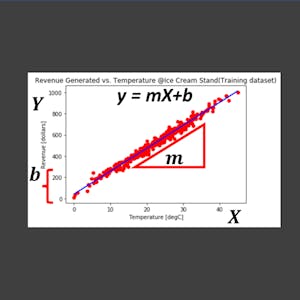

Hello everyone and welcome to this hands-on guided project on simple linear regression for the absolute beginner. In simple linear regression, we predict the value of one variable Y based on... more

In this specialization, you will receive an introduction to human anatomy and physiology! Together, we will explore foundational concepts as well as the structure (anatomy) and function... more

Unlock Your Marketing Potential with Copilot\\n\\nIn today\'s fast-paced, data-driven marketing landscape, staying ahead requires more than just creativity; it demands efficiency and precision. Our... more

Develop a greater appreciation for how the air, water, land, and life formed and have interacted over the last 4.5 billion years.Created by: University of Manchester more

This course discusses practical ways to implement Adobe Commerce, focusing on key pre-built features, best practices for success, and effective strategies for implementing an Adobe Commerce... more