Investment Banking: M&A and Initial Public Offerings

About this Course

This course focuses on examining various practical applications of the fundamental financial analysis and valuation techniques employed in the investment banking industry. Specifically, we will examine how to analyze how a private equity firm or other financial sponsor completes a leveraged buyout of a company, how a public company analyzes the impact of acquiring a company on its earnings per share, and how a company completes an initial public offering. The course will benefit anyone who desires to increase their ability to understand and execute M&A and capital markets transactions, including (but not limited to), entrepreneurs, consultants, bankers, investors, analysts, corporate managers, marketers, strategists, and dealmakers of all types.Created by: University of Illinois Urbana-Champaign

Related Online Courses

Welcome to the \"Fundamentals of NestJS\" course for Modern Backend Development, where you will embark on a comprehensive journey to become a proficient NestJS developer. This course is divided... more

This is a self-paced lab that takes place in the Google Cloud console. Lab has instructions to conduct distributed load testing with Kubernetes, which includes a sample web application, Docker... more

Unlock Your Marketing Potential with Copilot\\n\\nIn today\'s fast-paced, data-driven marketing landscape, staying ahead requires more than just creativity; it demands efficiency and precision. Our... more

This specialization covers essential skills in Python programming, data preparation, and foundational machine learning techniques such as linear regression and classification, providing a... more

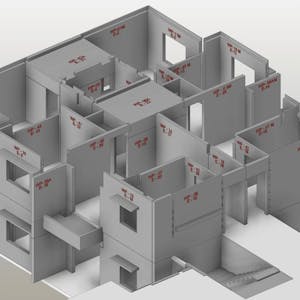

The \"Precast Structural System\" course offers a comprehensive exploration of precast elements in modern construction, covering everything from fundamental concepts to advanced design and... more